You have the dream. You have ambition. You might even have the acceptance letter from that amazing university in the UK or Germany. But then comes the biggest question: How on earth are you going to pay for it?

Let’s be real. Studying abroad is expensive. The tuition fees, the living costs, the flights – it all adds up to a significant amount. For most Indian families, funding this entirely from savings isn’t realistic.

This is where a student loan transforms from a scary financial term into the most powerful tool you have. An education loan isn’t debt; it’s an investment in your future. It’s the bridge that connects your academic potential to your global career aspirations.

But navigating the world of study abroad loans in India can feel like wading through a jungle. Which bank is best? What’s the difference between secured and unsecured? What documents do you need? It’s confusing and stressful.

That’s why we’re here. At Clifton Study Abroad Consultancy, we are more than just overseas education consultants. We are your partners in making this entire journey smooth and hassle-free, and that absolutely includes securing the right funding. As the best consultancy for abroad studies, we’ve helped thousands of students successfully finance their dreams. This guide is your first step towards understanding how you can too.

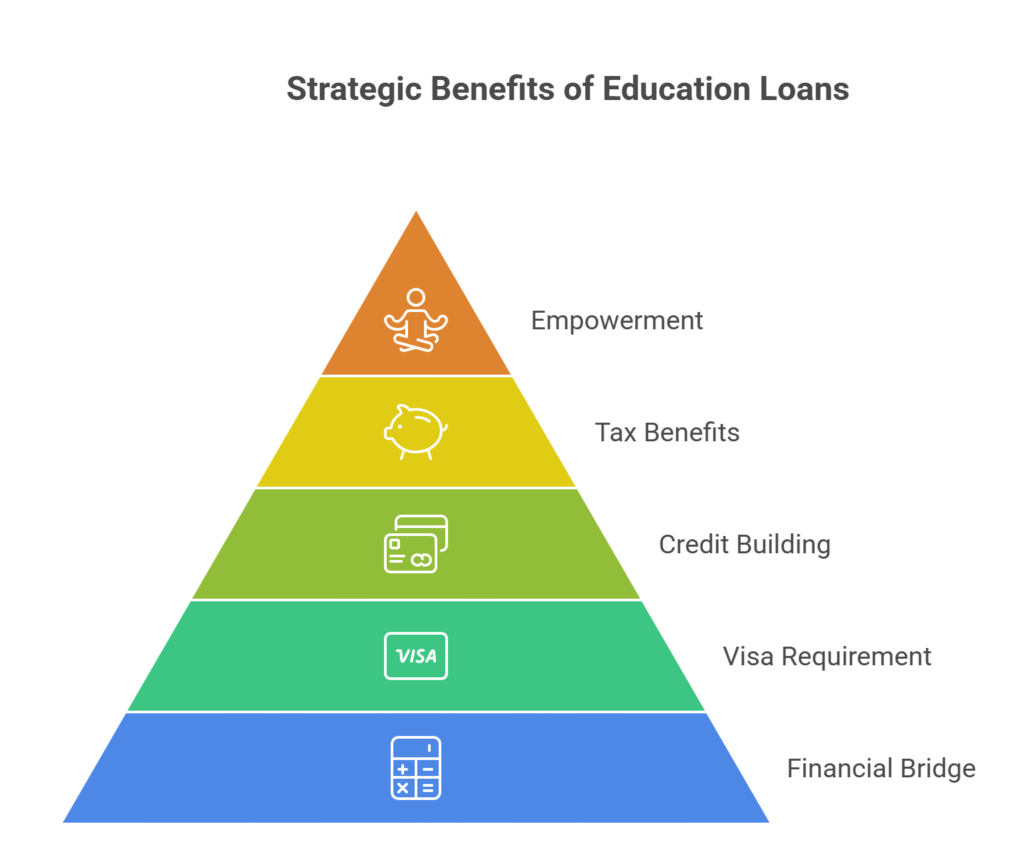

Why Student Loans Are Crucial for Studying Abroad

For many Indian students, an education loan isn’t just an option; it’s the option. It is the key enabler that makes studying abroad possible. Here’s why embracing a student loan is often the smartest strategic move:

- Bridging the Gap: It covers the substantial difference between your family’s savings and the actual total cost (tuition + living expenses).

- Proof of Funds for Visa: This is critical. Most countries (like the UK, Ireland, Australia) require you to show proof that you have enough funds to cover your entire first year of tuition and living costs before they grant your student visa. A sanctioned education loan letter is often the primary way students meet this requirement.

- Building Credit History: Responsibly managing an education loan helps you build a positive credit history, which can be beneficial later in life.

- Tax Benefits: Under Section 80E of the Income Tax Act in India, the interest paid on an education loan is eligible for deduction from your total income, providing significant tax savings.

- Empowerment: Taking ownership of financing your education fosters a sense of responsibility and motivates you to make the most of your investment.

Types of Study Abroad Loans in India: Secured vs. Unsecured

Understanding the two main categories of education loans is the first step. The difference lies in one key word: collateral.

1. Secured Loans (Loans with Collateral)

- What it means: These loans require you or your co-applicant (usually a parent) to pledge an asset to the bank as security. This asset is called collateral.

- What kind of collateral? This can be immovable property (like a house, flat, or non-agricultural land) or liquid assets (like Fixed Deposits, life insurance policies, or government bonds).

- The Pros:

- Higher Loan Amounts: Because the bank has security, they are often willing to lend much larger amounts, sometimes covering 100% of your expenses. This is often necessary for expensive destinations.

- Lower Interest Rates: The risk for the bank is lower, so they typically offer a lower interest rate compared to unsecured loans.

- Longer Repayment Periods: You might get a longer tenure (10-15 years) to repay the loan.

- The Cons:

- Requires Eligible Assets: Not everyone has property or large FDs to pledge.

- Valuation Process Takes Time: Getting the property valued and checking the legal documents can significantly slow down the processing times.

- Risk to Asset: If you default on the loan, the bank has the right to seize the collateral.

2. Unsecured Loans (Loans without Collateral)

- What it means: These loans do not require you to pledge any assets. The bank approves the loan based on your academic profile and your co-applicant’s income and creditworthiness.

- The Pros:

- Faster Processing: Since there’s no property valuation involved, these loans can often be approved much faster.

- No Asset Risk: Your family home is not on the line.

- Accessible: Available even if you don’t own property.

- The Cons:

- Lower Loan Limits: Banks typically have a cap on unsecured loans (often ₹40 Lakhs to ₹75 Lakhs, though some NBFCs go higher). This might not be enough for very expensive courses or universities.

- Higher Interest Rates: The risk for the lender is higher, so the interest rate is usually higher than for secured loans.

- Stricter Income Requirements: The bank heavily scrutinizes the co-applicant’s income and credit score.

As your study abroad consultants near me, Clifton helps you understand which type of loan is the best fit for your financial situation and your chosen university’s cost.

Top Indian Banks Offering Education Loans

Several banks in India have dedicated schemes for studying abroad. Here’s a look at some of the leaders in 2025. (Note: Interest rates and specific terms are indicative and can change frequently. Always check directly with the bank.)

State Bank of India (SBI)

SBI is often the first choice for many due to its reach and reputation.

- Key Scheme: SBI Global Ed-Vantage Scheme (for abroad studies).

- Loan Type: Primarily secured loans (requires collateral for amounts above ₹7.5 Lakhs).

- Loan Amount: Up to ₹1.5 Crore (or potentially higher, depending on collateral value).

- Interest Rate (Approx.): Typically linked to MCLR, often competitive, ranging from 10% to 12% p.a. Special concessions for female students might be available.

- Repayment: Moratorium period (course duration + up to 1 year). Repayment tenure up to 15 years.

- Pros: Nationwide network, potentially lower interest rates, high loan amounts possible with strong collateral.

- Cons: Processing can sometimes be slower due to bureaucratic procedures; strict collateral requirements.

HDFC Credila

HDFC Credila is a specialized Non-Banking Financial Company (NBFC) focused only on education loans.

- Key Scheme: Tailored loans for specific countries and courses.

- Loan Type: Offers both secured and unsecured loans. Known for higher unsecured loan limits than many public banks.

- Loan Amount: Up to ₹1 Crore or even higher, depending on profile and collateral (if offered). Unsecured limits often go up to ₹50 Lakhs – ₹75 Lakhs.

- Interest Rate (Approx.): Generally higher than public banks, especially for unsecured loans, often ranging from 11% to 14% p.a.

- Repayment: Flexible repayment options, often starting immediately or after the course. Tenure up to 10-12 years.

- Pros: Faster processing times, higher unsecured loan amounts, deep expertise in study abroad funding, door-step service.

- Cons: Higher interest rates compared to public banks, potentially stricter income criteria for co-applicants on unsecured loans.

Axis Bank

Axis Bank is another major private sector player with dedicated study abroad loan products.

- Key Scheme: Axis Bank Education Loan for Study Abroad.

- Loan Type: Offers both secured and unsecured loans.

- Loan Amount: Up to ₹1 Crore or more (secured), Unsecured typically capped around ₹40 Lakhs – ₹50 Lakhs.

- Interest Rate (Approx.): Competitive rates, often between 11% and 13.5% p.a., depending on loan type and applicant profile.

- Repayment: Moratorium period available. Tenure up to 15 years.

- Pros: Relatively quick processing, good customer service, competitive rates.

- Cons: Unsecured loan caps might be lower than some NBFCs.

ICICI Bank

ICICI Bank provides comprehensive education loan options for studying overseas.

- Key Scheme: ICICI Bank iSMART Education Loan.

- Loan Type: Both secured and unsecured options.

- Loan Amount: Need-based financing, often up to ₹1 Crore (secured). Unsecured limits similar to other private banks.

- Interest Rate (Approx.): Generally competitive, in the 10.5% to 13% p.a. range.

- Repayment: Moratorium period (course + 6 months). Tenure up to 10-12 years.

- Pros: Wide range of approved courses, digital application process, competitive rates.

- Cons: Collateral requirements can be specific.

Union Bank of India

A reliable public sector bank offering education loans under government schemes.

- Key Scheme: Union Education – Vidya Lakshmi (often used for abroad).

- Loan Type: Primarily secured for higher amounts (above ₹7.5 Lakhs).

- Loan Amount: Up to ₹1.5 Crore or more, based on need and collateral.

- Interest Rate (Approx.): Often linked to MCLR, generally competitive, similar to SBI.

- Repayment: Moratorium available. Tenure up to 15 years.

- Pros: Government backing, potentially lower interest rates.

- Cons: Processing might be slower; requires eligible collateral for large amounts.

Key Factors: Comparing Loans Like a Pro

When you get loan offers, don’t just look at the big number. You need to compare the details.

Comparing Interest Rates, Repayment Terms, & Processing Times

- Interest Rates:

- Fixed vs. Floating: Fixed rates stay the same throughout the loan; floating rates change based on market conditions (like MCLR). Floating rates might start lower but carry risk.

- The Spread: Banks often quote “MCLR + Spread.” Understand the total effective rate.

- Compare APR: Look at the Annual Percentage Rate, which includes fees, for a true comparison.

- Repayment Terms:

- Moratorium Period: This is the “holiday” period during your studies (plus usually 6-12 months after) when you don’t have to make full payments (sometimes only simple interest). A longer moratorium is better.

- Loan Tenure: How long do you have to repay? Longer tenure means lower monthly payments (EMIs), but you pay more interest overall.

- Processing Times:

- Urgency Matters: How quickly do you need the loan sanctioned for your visa? Unsecured loans from NBFCs like HDFC Credila are often the fastest (7-15 days). Secured loans from public banks like SBI can take 3-6 weeks or even longer due to property checks.

Documents Required for Study Loans

This is often the most frustrating part. Be prepared to gather a lot of paperwork. While the exact list varies slightly by bank, here’s a general checklist:

- Student Documents:

- Completed Loan Application Form

- Passport Size Photographs

- Proof of Admission (Offer Letter from the University)

- Academic Documents (Mark sheets – 10th, 12th, Graduation)

- Standardized Test Scores (IELTS, PTE, GRE if applicable)

- ID Proof (Passport, Aadhaar Card)

- Address Proof

- Co-Applicant Documents (Parents/Guardian):

- ID Proof & Address Proof

- Income Proof (Latest Salary Slips, Form 16/IT Returns for last 2-3 years, Business financials if self-employed)

- Bank Statements (Last 6-12 months)

- Proof of Relationship with the student

- Collateral Documents (For Secured Loans):

- Property Title Deed

- Registered Sale Agreement

- Latest Property Tax Receipts

- Approved Building Plan

- Non-Encumbrance Certificate (NEC)

- Legal Opinion Report & Valuation Report (Bank will arrange this, but you pay for it)

- For Liquid Assets: FD receipts, Insurance policy documents, etc.

How Clifton Makes Securing Your Loan Hassle-Free

Reading that document list probably made your head spin. Imagine trying to coordinate all that with multiple banks while also preparing for your visa interview!

This is where Clifton Study Abroad Consultancy steps in as your financial ally. We make the complex loan process simple and stress-free.

We Are Your Loan Matchmakers

You don’t need to visit 10 different banks. Our expert study abroad counsellor team does the initial assessment:

- We analyze your financial profile, your chosen course cost, and your collateral availability.

- We then recommend the 2-3 best banks or NBFCs that are the perfect fit for your specific situation. We know which lenders favour certain profiles or have faster processing for specific countries.

We Are Your Document Masters

We provide you with a crystal-clear, customized document checklist for the banks we’ve shortlisted.

- Our team helps you gather and organize every single piece of paper.

- We meticulously review your documents before submission to catch any errors that could cause delays.

We Are Your Bank Liaisons

We don’t just hand you a list and wish you luck.

- We leverage our established relationships with loan officers at major banks and NBFCs.

- We help you submit the application correctly and follow up diligently on your behalf.

- We help you understand and compare the final loan sanction letters, ensuring you get the best possible terms.

Our goal is simple: to make securing your education loan as smooth and hassle-free as your university application. This comprehensive support is why we are considered the best consultancy for abroad studies.

Conclusion

Financing your study abroad dream is achievable. An education loan is a powerful tool, an investment that unlocks a future of global opportunities. The key is to approach it strategically, understand your options, compare the details, and prepare your documentation meticulously.

You don’t have to navigate this complex financial journey alone. Let Clifton Study Abroad Consultancy be your guide. We simplify the process, connect you with the right lenders, and ensure you secure the funding you need with complete peace of mind. Your world-class education is within reach. Let’s build that bridge together.

FAQ Section

Which bank is best for study abroad loans in 2025?

There’s no single “best” bank; it depends on your profile. SBI often offers lower rates for secured loans but can be slower. HDFC Credila is faster and offers higher unsecured amounts but usually has higher rates. Axis and ICICI offer a good balance. The best approach is to compare offers based on your specific needs, something Clifton helps you do.

What is the maximum amount Indian students can borrow?

For secured loans (with collateral), banks like SBI or private banks can lend up to ₹1.5 Crore or even more, depending on the value of the collateral and the total cost of education. For unsecured loans, the limit is typically between ₹40 Lakhs and ₹75 Lakhs, although some specialized lenders might go higher for top universities.

Do I need collateral for education loans?

Not always. Unsecured loans (without collateral) are available, but they usually have lower limits and higher interest rates. For loans above a certain amount (often ₹7.5 Lakhs for public banks, higher for private lenders), collateral is typically required.

Are there interest-free loans for studying abroad?

No, unfortunately, interest-free loans for studying abroad are generally not available from major Indian banks or financial institutions. All education loans come with an interest rate. However, some charitable trusts or specific government schemes might offer interest subsidies or scholarships that effectively reduce the cost.

How can Clifton Study Abroad help me get a loan easily?

Clifton makes the process hassle-free in several ways:

- We assess your profile and recommend the best-fit banks/lenders.

- We provide a clear document checklist and help you prepare everything correctly.

- We leverage our bank relationships to facilitate smoother and sometimes faster processing.

- We help you compare loan offers to ensure you get the best terms. Our expertise saves you time, reduces stress, and increases your chances of securing the loan you need.

0 Comments